Gold-backed lending glows in banks’ retail books: RBI data

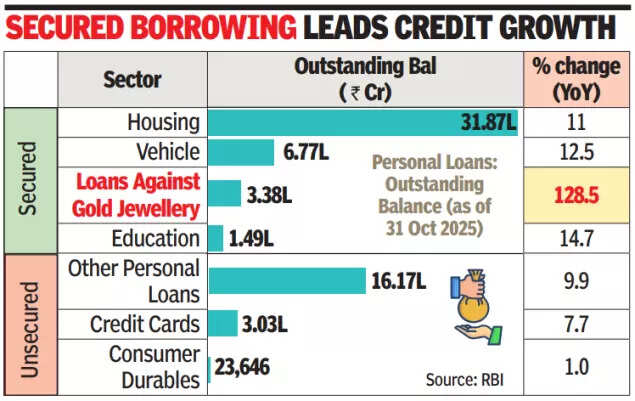

MUMBAI: Loans against gold jewellery have become the unlikely star of retail credit with outstanding balances in this category surging 128.5% year-on-year to Rs 3.38 lakh crore in Oct 2025 and 63.6% since March 2025. Gold loans now account for nearly a fourth of the addition to the bank’s personal loan book in the last 12 months.Personal loans, already the engine of credit growth, rose 14% over the year to Rs 64.56 lakh crore in end Oct. RBI, which published the latest sectoral deployment data on Friday, said that part of the jump in gold loans was because of a reclassification by banks in May 2024 that shifted agricultural loans secured by jewellery into the retail gold-loan bucket in line with regulations.

The boom in personal loans continues to rest on secured borrowing. Housing loans increased 11% year-on-year to Rs 31.87 lakh crore, vehicle loans 12.5% to Rs 6.77 lakh crore and education loans 14.7% to Rs 1.49 lakh crore. The unsecured end of the retail market grew slower in single digits. Consumer-durable loans inched up 1% to Rs 23,646 crore, credit-card outstandings grew 7.7% to Rs 3.03 lakh crore and other personal loans rose 9.9% to Rs 16.17 lakh crore.Retail demand continues to prop up bank credit, which grew 11.3% year-on-year to Rs 193.9 lakh crore in Oct 2025 and 6.3% in the seven months since March. Non-food credit, which represents almost all lending, increased at a similar 11.1% to Rs 193.2 lakh crore.Among non-retail sectors, services remain the driver. Lending to the sector climbed 13% year-on-year to Rs 53.45 lakh crore, powered by sharp gains in computer software (29.4%), shipping (28%) and commercial real estate (14.1%). NBFCs continue to attract banks: exposure rose 10.9% to Rs 17.04 lakh crore, with public financial institutions expanding faster than housing finance companies.Industry credit grew 10% year-on-year to Rs 41.93 lakh crore largely powered by micro and small firms which saw lending jump 25.9% to Rs 9.54 lakh crore, credit to medium enterprises rose 17.6% to Rs 3.98 lakh crore and large companies only 4.6% to Rs 28.41 lakh crore. Credit appetite remains restricted in the lower rungs of the corporate pyramid, with top corporates raising funds from bonds, equities and external commercial borrowings which are not reflected in bank numbers. Lending to agriculture and allied activities was steadier, up 8.9% to Rs 24.03 lakh crore.In priority-sector renewable energy, lending rose 52.1%, priority housing 32.7% and micro and small enterprises 25.8%. Social-infrastructure lending shrank and export credit contracted.